They have different calculations and have entirely different purposes for determining how a company is doing. Fixed costs might include rent of production disaster relief resource center for tax professionals building, advertising, and office supplies. It typically includes direct material cost, direct labor cost, and direct factory overhead.

Create a Free Account and Ask Any Financial Question

This makes net income more inclusive than gross profit and can provide insight into the effectiveness of overall financial management. Net income shows the profit from all aspects of the business operations of the company. The additional interest expenses for the debt incurred could lead to a decrease in net income despite efforts of the company for successful sales and production. The purpose of net income and gross profit are entirely different in terms of determining the success of the company. Expenses that factor into the net income are COGS, operating expenses, depreciation and amortization, interest, taxes, and all other expenses.

- Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- Revenue is the total money your company makes from its products and services before taking any taxes, debt, or other business expenses into account.

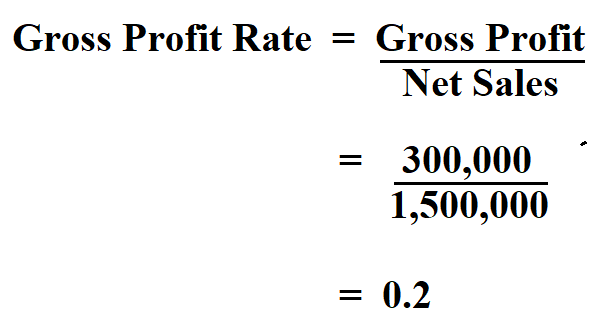

- The gross profit percentage is the gross profit of the business expressed as a percentage of the revenue.

- On the income statement, the gross profit line item appears underneath cost of goods (COGS), which comes right after revenue (i.e. the “top line”).

- Using a gross margin formula calculator helps an organization to understand their production costs and basic financial health derived through their core activities in percentage format.

- Net income reflects the profit earned after all expenses, while gross profit focuses solely on product-specific costs.

Get Help Keeping Your Finances Straight

We’ll explore the formula for calculating gross profit and how gross profit compares to profit margin. We’ll also look at why gross profit is important to help you develop this essential business metric. Gross profit is calculated by subtracting the cost of goods sold from the business’s revenues for a given period. Cost of goods sold includes the cost of inventory sold to customers or the cost of services provided, like materials, tools, freight, and labor, incurred while generating revenues. A high gross profit margin means that the company did well in managing its cost of sales. It also shows that the company has more to cover for operating, financing, and other costs.

Example of Gross Profit Margin

Unlike software and related services — which represent sources of recurring revenue — hardware products are one-time purchases. Generally speaking, a company with a higher gross margin is perceived positively, as the potential for a higher operating margin (EBIT) and net profit margin rises. Gross profit is the difference between net revenue and the cost of goods sold. Total revenue is income from all sales while considering customer returns and discounts. Cost of goods sold is the allocation of expenses required to produce the good or service for sale. It is crucial to take the company’s overall financial health into account when making management decisions.

How does gross profit percentage affect my business’s financial health?

Together, they give you an idea of your business’s financial health, empowering you to track trends and make quick business decisions. COGS doesn’t include costs such as rent, utilities, payroll taxes, credit card readers, and advertising. You don’t include these indirect costs because they aren’t considered the materials or services you need to directly make your product. It shows how effectively you use your resources—direct labor, raw materials, and other supplies—to produce end products.

Step 4: Calculate Gross Profit

Gross profit assesses the ability of the company to earn a profit while simultaneously managing its production and labor costs. It does not include fixed costs, which are expenses that do not change based on production levels. COGS, also referred to as “cost of revenue” or “cost of sales”, refers to the direct costs involved in creating a product. Net sales tell more about the financial health of a business than total sales. John Trading Concern achieved a gross profit ratio of 25% during the period.

Gross profit helps determine whether products are being priced appropriately, whether raw materials are inefficiently used, or whether labor costs are too high. Gross profit helps a company analyze its performance without including administrative or operating costs. The gross profit percentage formula is calculated by subtracting cost of goods sold from total revenues and dividing the difference by total revenues.

Gross profit is a company’s total profit after deducting the cost of doing business, specifically its COGS, and is expressed as a dollar value. Gross profit margin, on the other hand, is this profit expressed as a percentage. The gross profit method is an important concept because it shows management and investors how efficiently the business can produce and sell products. To calculate gross profit, subtract the cost of goods sold from the sales revenue. A company might have low gross profit because it has high production costs. To lower these production costs, the company might need to invest in new technology or hire more experienced staff.